nanny tax calculator california

A household employer is responsible to remit 765 of their workers gross wages in FICA taxes. Then print the pay stub right from the nanny salary calculator.

Babysitter Taxes Should A Nanny Get A 1099 Or W 2 H R Block

These rates are the default rates for employers in Pennsylvania in a locality that.

. This rate will increase by 100 per hour each year until it reaches 15 per hour in 2023. This calculator is intended to provide general payroll estimates only. If you make 70000 a year living in the region of California USA you will be taxed 15111.

California minimum wage rate is 1400 per hour. The 2022 tax rate is 11 percent includes disability insurance and paid family leave on the first 145600 in SDI taxable wages paid to an employee each year. Use The Nanny Tax Companys nanny payroll calculator to calculate nanny pay and withholding.

This breaks down to 62 for Social Security and 145 for Medicare. Your employer withholds a 62 Social Security tax and a. Use The Nanny Tax Companys hourly nanny tax calculator to calculate nanny pay and withholding.

Employers need to withhold around 13-20 of their nannys gross wages to pay for the nanny tax. The Nanny Tax Company has. This calculator allows you to get an idea of how much you will pay and how much your nanny will take home.

To take this tax break use IRS Form 2441 to itemize care-related expenses on your federal income tax return. Your average tax rate is 1198 and your marginal. Our experts are available to answer your questions about paying household employees.

For specific tax advice and guidance please call us toll free at 877-626-6924 and a NannyChex. Child or Dependent Care Tax Credit. Many California cities have local minimum wages.

A majority of families will receive a 20. California Income Tax Calculator 2021. Then print the pay stub right from the calculator.

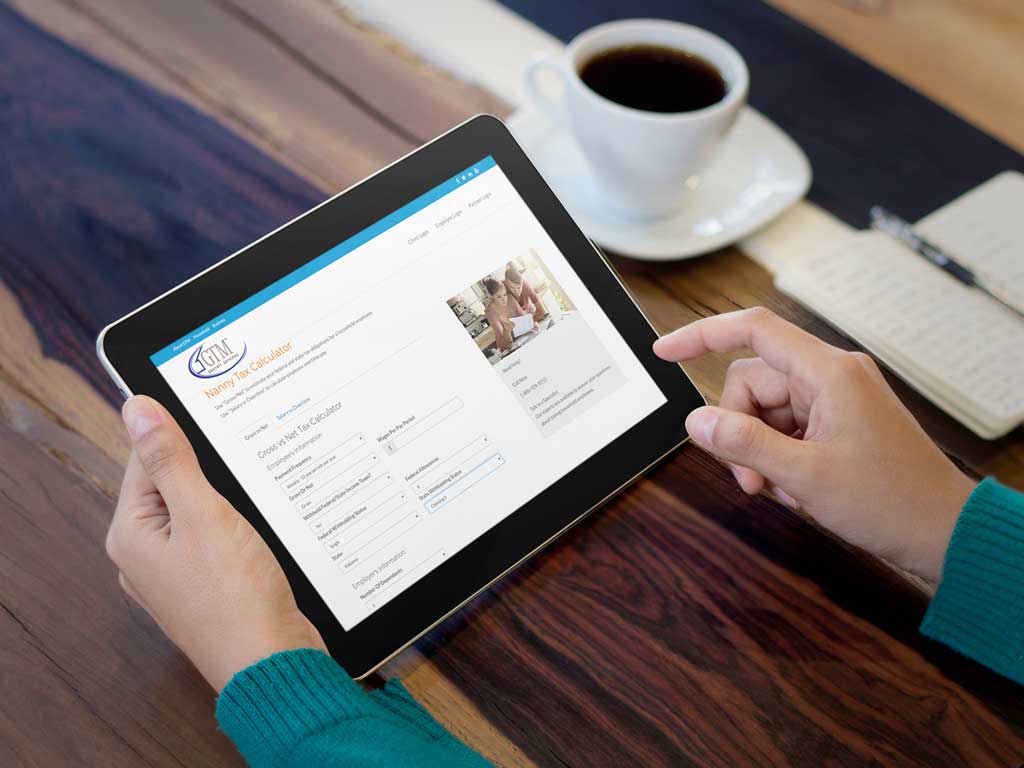

GTM Payroll Services provides this calculator as a means for obtaining an estimate of tax liabilities but should not be used as a replacement for formal calculations and does not. When calculating your take-home pay the first thing to come out of your earnings are FICA taxes for Social Security and Medicare. The Nanny Tax Company has.

Talk to a Specialist. As for Social Security and Medicare tax payment 765 will be shouldered by.

Full Service Nanny Tax Solution Poppins Payroll Poppins Payroll

The Benefits Of Legally Paying Your Nanny Nanny Lane

Nanny Tax Payroll Calculator Gtm Payroll Services

Nannychex Hourly Paycheck Calculator

Hourly Paycheck Calculator Business Org

The 10 Best Nanny Payroll Services Business Org

Nanny Tax Payroll Calculator Gtm Payroll Services

Payroll Calculators California Payroll

Nanny Tax Threshold For 2021 Sees Slight Increase Of 100

:max_bytes(150000):strip_icc()/NannyChex-9e1a8f2673cb456085445ee8fce1ab03.jpg)

The 8 Best Nanny Payroll Services Of 2022

California Paycheck Calculator Smartasset

5 Answers You Need When Using A Nanny Tax Calculator

Free Hourly Payroll Calculator Hourly Paycheck Payroll Calculator

How To Calculate Your Nanny Taxes

Breaking The Barriers To Legal Pay Nanny Magazine

How To Get Your Irs Employer Number Nanny Tax Tools

:max_bytes(150000):strip_icc()/SimpleNannypayroll1-9b1a589c58f14564abe6f039c8afd20f.jpg)

The 8 Best Nanny Payroll Services Of 2022